Delinquency rates remained low during the first half of 2019, indicating that Canadian mortgage borrowers were able to keep up with their repayments, according to a study by the Canada Mortgage and Housing Corporation (CMHC).

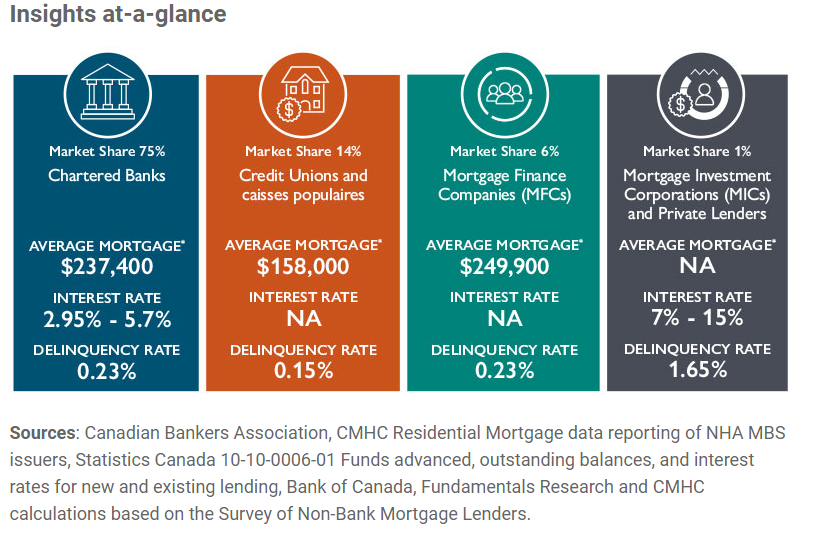

Credit unions, which take up a 14% share of the mortgage market, reported the lowest delinquency rate at 0.15%. Chartered banks and mortgage finance companies (MFCs) followed, with delinquency rates of 0.23%. Private lenders, which hold 1% of the market, clocked the highest delinquency rate at 1.65%.

"Under strong labour market conditions and with unemployment rates remaining at 40-year lows, Canadians continue to be able to cover their mortgage payments," the study said.

Also read: Is financial infidelity a thing among Canadians?

The growth in the labour market also helped boost new mortgages for the purchase of property, which increased by 1% year-on-year during the first three quarters of 2019.

In the same vein, mortgage transaction switches, which include renewals and refinances of existing loans, increased to 6.5% of the overall new mortgages.

The study also showed the increasing market presence of MFCs and mortgage investment entities (MIEs).

"Having maintained stable lending parameters and having reported decreasing realized losses in 2018, MICs and MIEs are seeing an increase in their average portfolio size, an increasing debt-to-capital ratio, and a declining trend of first mortgages," the CMHC said.

The infographic below shows detailed information about the market share of the four different types of lenders:

You can use Which Mortgage’s Repayment Calculator to get a snapshot of your monthly, bi-weekly, or weekly repayments.