The Canadian housing markets have been on a nine-month winning streak in terms of affordability, but concerns remain about how long the streak will last.

The proportion of household income being allocated for mortgage payments declined by 2.2 percentage points during the third quarter of the year, according to the National Bank of Canada's latest Housing Affordability Monitor.

Also read: 4 ways the federal government can improve housing affordability

This marked the third consecutive quarter of improving housing affordability, which was driven by the decline in mortgage rates.

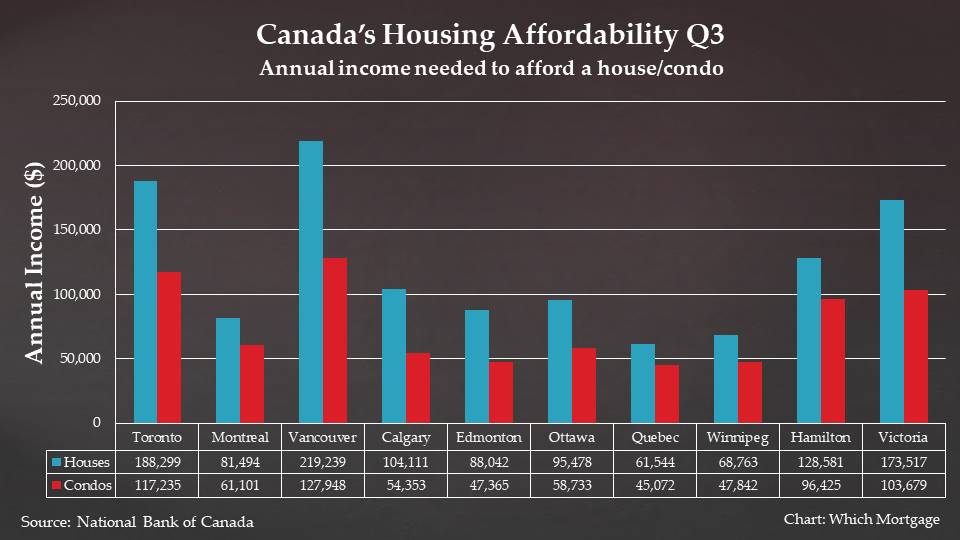

The study said mortgage payments for houses now take up only 43% of the average Canadian income, in line with the historical average. This improvement, however, is not felt across the country, with homeowners in metropolitan areas still struggling with housing costs.

"While our national housing affordability composite index is now in line with its historical average, it does not mean that the situation is back to normal in all metropolitan areas," the study said.

For instance, while the affordability in Toronto's condo and non-condo segments improved substantially since the last quarter of last year, prices are still above their historical average. In Vancouver, the area of concern is in its detached-housing segment.

In Toronto, homeowners allot 55.9% of their income to service their mortgages. In Vancouver, the affordability is worse — homeowners use 69.1% of their income for loan repayments.

The tables below show how much annual income is needed to afford a house or condo in major metropolitan areas:

Want to know if you can afford to buy a home? Try Which Mortgage’s Affordability Calculator.